Applying for the MoneyMe Credit Card Made Easy

Credit Card applications can often seem daunting, but obtaining a MONEYME Credit Card is a straightforward process that anyone can navigate.

In this article, we will explore the steps you need to take to successfully apply for a MONEYME Credit Card, including visiting their website, completing the online application, and providing necessary identification.

Get a credit card for low scores up to $1,500

Control your spending with a digital invoice card

Get instant credit card approval on mobile

We’ll also highlight the eligibility criteria you must meet to ensure your application is approved.

Lastly, we’ll touch upon the convenience of using the MoneyMe app, making the process even easier for you.

Quick Application Overview

Applying for the MoneyMe Credit Card has never been easier.

The entire process can be completed online in just a few minutes, enabling you to start using your virtual card almost instantly.

To begin, visit the MoneyMe website and access the secure online form.

| Step | Why it matters |

|---|---|

| Visit MoneyMe website | Begin secure application |

You’ll need your driver’s license for identification, so be sure to have it ready.

As you proceed, ensure you review all details to meet the eligibility criteria, such as being at least 18 years old, employed, and an Australian resident.

After you submit your application, the quick decision process will have you on your way with a new card in hand.

Embrace the simplicity by downloading their app, making access to updates and features conveniently just a tap away.

Gathering Requirements

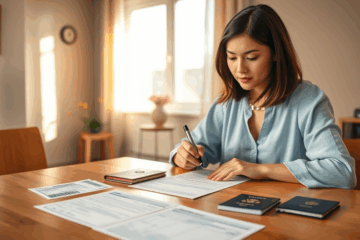

Gathering requirements is a crucial step in any application process.

Confirming personal eligibility ensures that you meet all necessary criteria before you begin, streamlining your experience.

Additionally, having identification on hand, such as a driver’s license, is essential to verify your identity and facilitate a smoother application.

Eligibility Essentials

For a successful application of the MoneyMe Credit Card, applicants must adhere to specific eligibility criteria, ensuring the right candidates benefit from this financial product.

Meeting these criteria enhances the chances of approval and smooth application processing.

Understanding these essentials allows applicants to prepare adequately before initiating the application process through the convenient online platform.

- Age: You need to be at least 18 years old to apply, ensuring financial responsibility.

- Residency: Applicants must be Australian residents, providing proof through identification documents like a driver’s license.

- Employment: Employees must show evidence of employment for steady income verification and financial stability.

- Income: Meet the minimum income requirements, ensuring the ability to manage credit repayments effectively.

Acceptable Identification

Having identification ready is crucial when applying for the MoneyMe Credit Card to facilitate a smooth and efficient application process.

You must provide one of the following identification documents to verify your identity:

- Driver’s License

- Birth Certificate

- Australian Passport

- Medicare Card

- Citizenship Certificate

These documents ensure that you meet the eligibility requirements and help expedite your application.

Therefore, ensure all documents are current and match your application information for a seamless experience.

From Online Form to Approval

The journey from completing the online form to receiving approval is designed to be seamless and efficient.

Applicants simply visit the MONEYME website or use the mobile app to start their application process.

Once they’ve submitted their information and met the eligibility criteria, they can quickly receive their approval notification, keeping the experience straightforward and user-friendly.

Accessing the Application Portal

To start your MoneyMe Credit Card application, visit the MoneyMe website and click on the credit card section for instant access to the application portal.

Ensure you have your driver’s license ready for verification, and complete the online form within minutes.

Alternatively, download the MoneyMe app from Google Play for mobile convenience.

Register an account, then go directly to the application section to initiate your credit card application quickly and effortlessly.

Final Submission & App Tracking

Ensure to double-check your details before hitting submit on your MoneyMe Credit Card application.

A swift review of your information can prevent unnecessary delays! Once this step is complete, the MoneyMe app becomes your essential toolkit.

With its user-friendly features, you benefit from real-time status updates, allowing you to stay informed throughout your application process.

Additionally, digital card activation makes it easy to start using your card immediately upon approval.

Lastly, the app provides spending controls to help you efficiently manage your finances, ensuring you’re always in control of your credit use.

Credit Card applications do not have to be complicated.

By following the outlined steps and ensuring you meet the eligibility criteria, you can enjoy the benefits that come with a MONEYME Credit Card in no time.